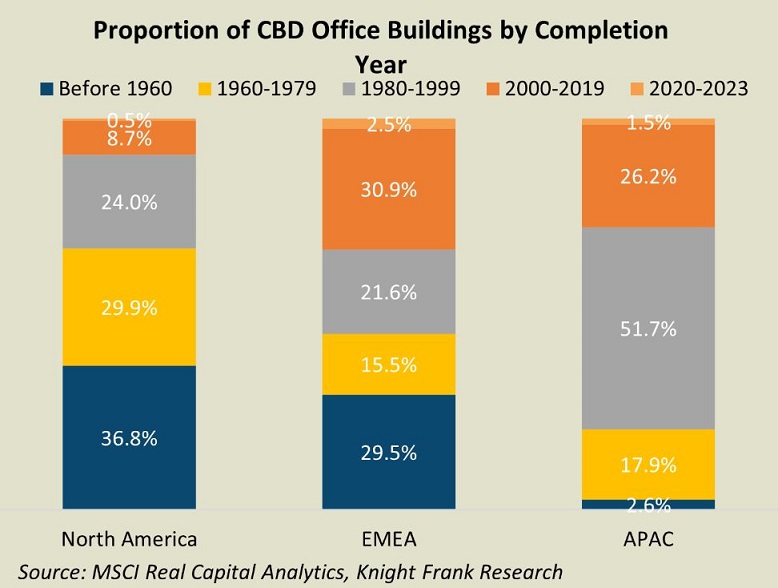

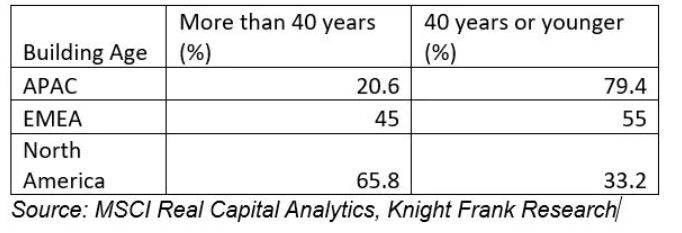

SINGAPORE (December 14, 2023) – At almost 80%, the overwhelming majority of office spaces in the APAC region are just 40 years old, or less. According to a new report titled Horizon: Asia-Pacific Tomorrow published by Knight Frank recently.

The nascent office market offers a unique opportunity to build offices with cutting-edge technology incorporated in to them, along with the latest amenities, aligning them with the growing emphasis on high-quality, green workspaces.

“Flight-to-quality” and flight-to-green” are the top building trends identified in the report, which predicts the journey of the commercial property market over the next 12 months, including the opportunities and challenges that they may have to face in the coming year.

Three reasons have been identified as being the basis for the Asia-Pacific office sector to be the backbone of the office-first hybrid strategy;

Trend 1: Emphasis on newer and ESG-certified buildings

Aligning with the increasing demand for ESG-compliant (environmental, social, governance compliant), sustainably built offices, the newer premium buildings in the APAC are set to bolster employee satisfaction, wellness, collaboration and productivity in a more conducive work environment.

Christine Li, head of research, Asia-Pacific and report author, says: “The less mature office market in Asia-Pacific proves advantageous, enabling the development of state-of-the-art office buildings with modern facilities without the concurrent risk of obsolescence, a preference gaining traction among occupiers in the region.

“Most of these CBD (Central Business District) office buildings in Asia-Pacific are newer, which suggests that they are more likely integrated with the latest technologies that enhance user experiences. Obsolescence is also minimised as retrofit works are less complicated and cost-effective.”

She adds: “As the ‘flight to quality’ and ‘flight to green’ trends gain momentum, Asia-Pacific emerges as the optimal choice for workplace transformation due to its up-to-date building technologies and availability of prime, ESG-compliant spaces tailored to company requirements. It also starkly contrasts to North America and EMEA where over 30% of office buildings, built before 1960, face a high risk of obsolescence, unable to keep pace with evolving tenant preferences in the hybrid work era.”

Trend 2: Access to a valuable talent pipeline

The Asia-Pacific stands out with a sizeable working population, where a significant segment of them reside in urban areas, and have a average literacy rate of 94%. Considering the advantageous demography of the region, the APAC is an attractive location for multinational corporations to establish their presence, where they can go so far as to minimise their manpower challenges which in turn, ensures a consistent demand for office space.

Trend 3: Prominent emergence of a two-speed market

A split in the Asia-Pacific office sector appears to be a reality, where certain occupiers are seen to take advantage of the softening leasing market to relocate to newer and ESG-compliant buildings, where they can fortify ESG credentials while improving employee satisfaction; while others are being financially prudent amidst the prevailing economic headwinds.

Ms Li adds: “Growth in headcount and capital expenditure (CAPEX) is highly contingent on the macroeconomic situation for the latter, and with economic turmoil brewing, companies continue to be conservative. This is supported by the Q3 2023 Knight Frank Cresa Corporate Real Estate Sentiment Index – a unique index assessing the outlook of the global corporate real estate community in relation to the growth, portfolio, and workplace dynamics – where growth dynamics have seen two consecutive quarters of improving sentiment, although they remain negative.”

Tim Armstrong, global head of occupier strategy and solutions said: “Although office attendance has now stabilised in the Asia-Pacific region, the rebound in demand for office space has yet to keep up with the strong employment rate. For 2024, while the trends of ‘flight-to-quality’ and ‘flight-to-green’ persist, the enthusiasm for expansion will be restrained. Tenants will continue to approach portfolio planning cautiously due to the difficult macroeconomic conditions. However, it also proves to be a good time to review portfolios to capitalise on softer rents.”