SINGAPORE (October 25, 2023) – According to global payments and financial platform Airwallex, 82% of global SMEs (86% in UK and US) are willing to change their traditional banking partners if their existing software platform offered a like-for-like alternative, which would include cross-border payments, business banking accounts, foreign exchange and treasury services.

Airwallex, in their Embedded Finance Report published jointly with Edgar, Dunn & Company consultancy, states that their findings show a clear demand for platforms such as eCommerce, CRM and expense management to be more involved in the operations of SMB customers, by offering financial solutions embedded into their existing software platforms – especially with respect to international fund transfer payments.

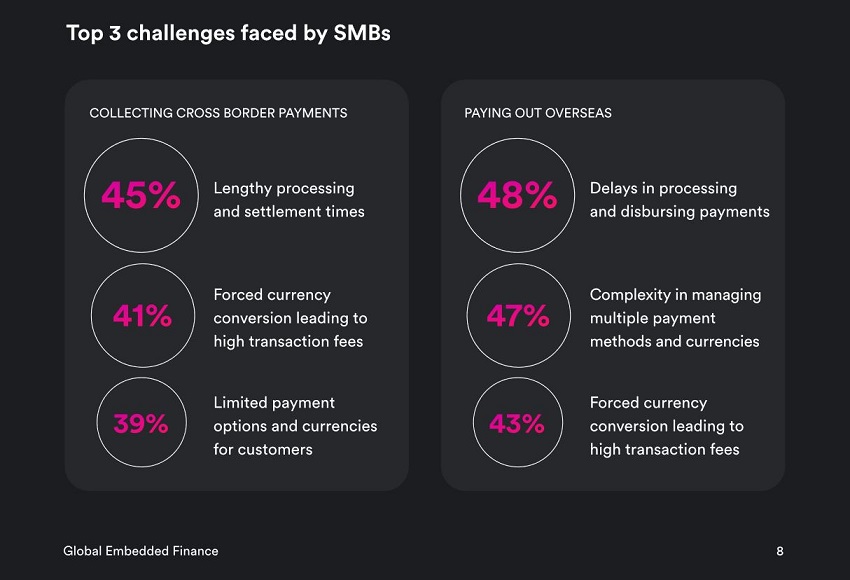

Among the difficulties faced by SMEs are lengthy settlement times (45%), an issue sharply felt in Singapore and Australia, with more than half (52%) of such businesses having to deal with payment delays. Forced currency conversions has been shown as the second most common issue, cited by 41% of respondents, particularly those from the UK. Outward transfers to vendors, suppliers and employees are also proving problematic with delays being experienced 48% of the time, going up to 58% in Australia.

In order to manage the multitude of issues in cross-border payments, these businesses feel that embedded end-to-end payments within their current software platforms would be a seamless and efficient solution. SMEs have expressed their willingness to pay more for this service to be included in their existing management software.

To this end, China (93%) and the USA (88%) have displayed the highest appetite for this inclusion, while Australia showed significantly less enthusiasm, at 66%; however this is because almost 20% of SMEs down under are already mobilising their software providers to embed financial options.

Shannon Scott, SVP, global head of product, Airwallex said: “Seamless cross-border payments are essential for digital-first SMBs, but our research highlights that these businesses think banks are missing the mark by not offering the right solutions to support their global ambitions.

“Software platforms and marketplaces are well-placed to fill this gap because they have closer relationships with their customers and understand the nuances of their industries. For example, if an eCommerce marketplace is interested in providing loans to their sellers, having visibility over their sellers’ payments processing will be essential to offering pre-approved funds or making well-informed risk assessments.

“Industry data consistently highlights the positive impact of embedded financial services on a software as a service (SaaS) company’s valuation and market capitalisation. The opportunities are huge, but untapped, for software providers to better serve customers with tailored offerings while unlocking new revenue streams for themselves,” he concluded.