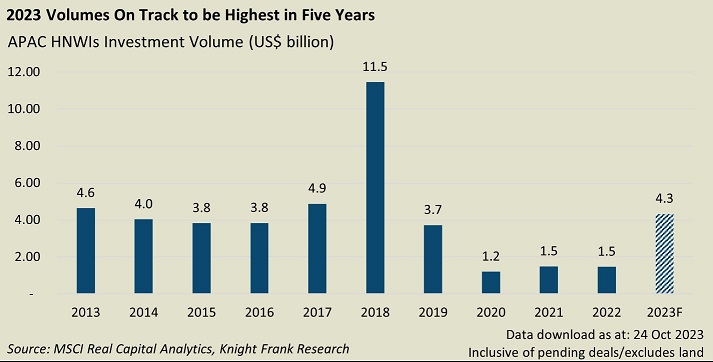

SINGAPORE (December 07, 2023) – According to Knight Franks’ report titled Horizon: Asia-Pacific Tomorrow, high-net-worth private individuals (HNWIs) are expected to be the main driving force behind the growth of the commercial real estate market in the Asia-Pacific region in 2024. With their abundance in cash reserves, the need to rely on debt for acquiring assets is eliminated. Thereby allowing these individuals to easily acquire assets at very competitive rates.

The report goes on to state that the HNWI’s investments in real estate is projected to be at its highest in five years, reaching $ 4.3 billion in 2023, and is expected to persist as a formidable force in the region’s commercial real estate market higher-for-longer interest rate environment.

Neil Brookes, global head of capital markets at Knight Frank, says: “The sharp rise in bond yields has shifted the investment landscape and altered the appeal of different asset classes. However, despite the challenging macro backdrop, ample capital remains to be deployed. As markets have come to grips that central banks will unlikely ease policy for some time, assets will continue to re-price in the region. Opportunities for private credit and attractive entry points for assets are likely to emerge in the higher-for-longer environment, which will continue to favour long-term private investors with a low reliance on debt.”

For this group of investors, decision-making is guided by the desire for capital preservation instead of higher yields. Based on the findings published in the ANREV 2023 Investment Intentions Survey, most respondents preferred core investment strategies, reaching the highest levels of this trend in the last 10 years. Market volatility has driven investors to prioritise stability, favouring core assets when making investment choices.

Christine Li, head of research, Asia-Pacific, and report author says: “The extensive withdrawal observed from both domestic and international investors suggests a continued reluctance to deploy capital in the current high interest rate environment. The yield spread has tightened to an extent where certain markets are experiencing negative risk premiums.

“In the current inflated environment, competition is thinner as investors wait on the side-lines for headwinds to die down. Refinancing risks have also caused some assets to be put up for distressed sale. However, with the right strategy and opportune time, investors can still get their hands on favourable assets that offer capital appreciation and positive rental reversions, especially in thematic sectors such as living sectors, life sciences, and data centres.”

Li adds: “The shift to a core strategy was expected since these assets are known for their stability, lower risk profiles, long-term appreciation, stable cash flow and inflation hedge, which are advantageous in the current inflationary environment. Despite certain Central Banks in the region beginning to lower rates to stimulate economic growth, the likelihood of sustained elevated interest rates until the end of 2024/early 2025 leads us to project that investors will maintain a strong interest in core assets to mitigate portfolio risks.”

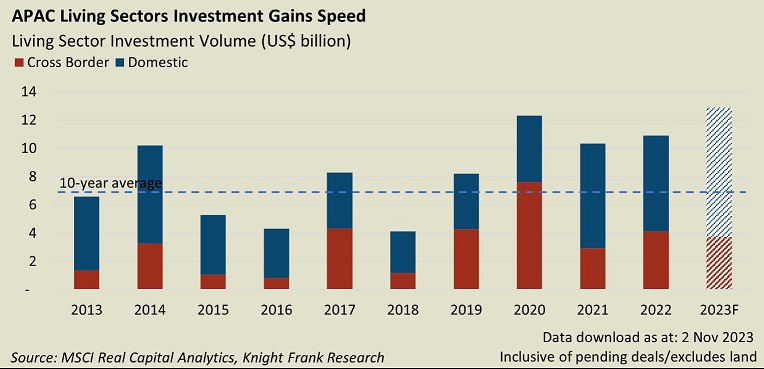

One of the key asset classes that has seen investors ramping up capital allocation, is the living sectors, according to the Horizon: Asia-Pacific Tomorrow report.

Emily Relf, head of living sectors, Asia-Pacific, says: “Encompassing diverse real estate categories to meet the needs of individuals at various life stages—including student housing, co-living spaces, multi-family properties, and senior living facilities—the sector exhibits defensive characteristics influenced by demographic changes, evolving lifestyles, and technological advancements.”

She adds: “Given the lack of multifamily rental products in the region, investors are also exploring development options, particularly in the Australian build-to-rent (BTR) market, where it has quickly gained interest, and has the potential for showing its largest stock expansion over the next decade. As many as 55,000 BTR units are expected to be delivered by 2030, almost seven-fold the existing inventory.”

The Chinese mainland is another up-and-coming living sectors market. Though still in its formative stages, the sector holds noteworthy growth opportunities due to its vast population of 1.4 billion and the challenges that families and young professionals encounter when purchasing apartments.

Some institutional players have already forayed into the country, capitalising on the aforementioned factors, and strategically gaining first-mover advantages.