By Team ABT –

Fintech momentum continues to grow globally despite uncertainty in the broader economy and the Southeast Asian (SEA) region presents a world of opportunities. The region’s emerging economies, expanding population and growing middle class resulted in Fintech investments across the 10 ASEAN nations reaching US$ 4.3 billion (S$ 5.72b) in the first nine months of.

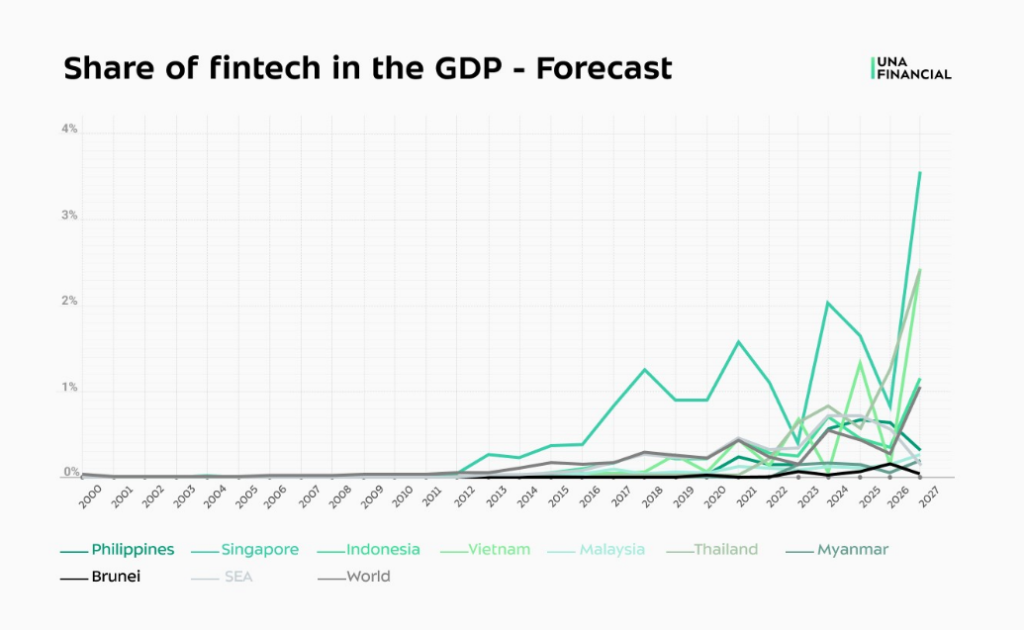

Analysts at UnaFinancial have revealed that in 2022, 0.32% of Southeast Asia’s GDP consisted of venture and other investments in the fintech industry. However, this will take a dramatic turn by 2027, by which time this share is projected to reach 1.65%, growing 5 times. Among the countries of the region, Singapore will have the largest share of fintech investments in its GDP – 3.56% (+2.45%).

UnaFinancial, a group of companies that offer digital solutions to entities across Asia and Europe, studied the investment situation of 8 countries across the South East Asian region; Singapore, Indonesia, the Philippines, Vietnam, Malaysia, Thailand, Myanmar and Brunei.

Singapore showed the highest investment attractiveness in 2022, where 41% of its GDP was direct investments. This was followed by Brunei (22%), Myanmar (11%) and Malaysia (6%). The analysts commented that: “Such a distribution of the countries is not surprising, given their respective economic performance indicators, such as GDP per capita, R&D intensity and labour productivity.”

Fintech in the volume of direct investments in the SEA region amounted to 3.82%, with Indonesia holding the largest portion of it (13.5%). Singapore held 2.7%. According to UnaFinancial’s experts: “Singapore is leading fintech development and digitalisation in SEA, because it has all the necessary conditions for it. However, Indonesia is catching up with it. Being the most populated country in the region, Indonesia holds an increased potential for economic growth driven by the introduction of fintech services.”

Fintech affected the GDP growth the most in Singapore. In 2022, the share of fintech investments in the country’s GDP amounted to 1.11%, while in the region, this figure was 0.32% and globally it was 0.25%.

The above forecast based on the vector error correction model revealed that by 2027, the share of fintech investment in the GDP of the SEA region may grow fivefold, and make this figure 1.65%. Singapore will show the largest fintech investments in its GDP with 3.56% (+2.45%), followed by Vietnam at 2.42% (+2.27%), Thailand at 2.40% (+2.19%), Indonesia at 1.15% (+0.86%), the Philippines at 0.31% (+0.18%), Malaysia at 0.26% (+0.16%), Myanmar at 0.20% (+0.20%) and Brunei at 0.03% (+0.03%).

Globally, this indicator is projected to be 1.07% (+0.82%). “We expect that over the next 5 years, the return on investment in Southeast Asia’s fintech will increase, which will gradually augment its position as a driver of economic growth,” the experts say.

However, Singapore isn’t without its challenges, and a new report by EDB, PwC Singapore and the Singapore Fintech Association contains information on Singapore’s collaborative approach to developing the digital economy, including the schemes and initiatives offered to Fintechs. A group of business leaders came together during the launch of this report and offered their insights on how the country will make this happen, including the establishment of a common language around measuring green progress, using blockchain as a catalyst for greener business practices, harnessing regulations to their advantage and addressing talent uncertainty with a robust ecosystem of partners.