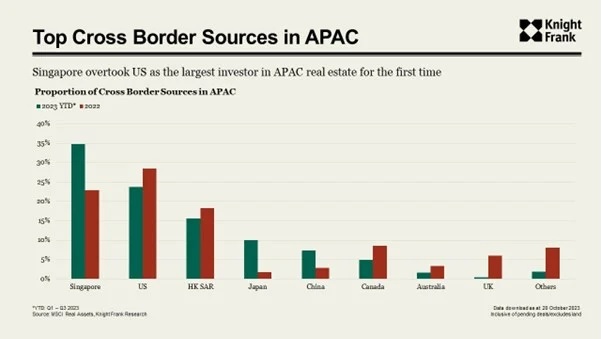

SINGAPORE (November 01, 2023) – According to Knight Frank’s Asia-Pacific researchers, Singapore was placed as the primary source of APAC real estate investment year-to-date in Q3 2023, surpassing the US for the first time. Investors in Singapore have injected more than $ 8.5 billion into the region, driving Singapore’s investment value more than 50% beyond that of the US.

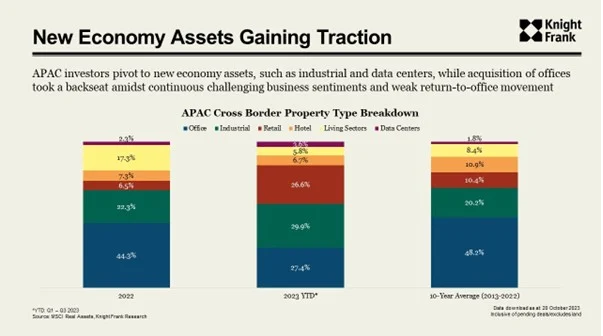

Limited movement was observed in Q3 this year in the Asia-Pacific region, with investment activity going down by 53.4%, year-on-year, highlighting the reluctance of both local and foreign investors to commit to the current high-interest rate environment. To deal with this negativity, APAC investors have shifted their focus to new economic assets, particularly in the data centre and industrial sectors.

Christine Li, head of research Asia-Pacific, said, “In response to these challenges, a growing portion of cross-border capital from APAC has been directed towards new economy assets such as industrial properties and data centers. For industrial properties, the combination of limited supply of institutional-grade assets and sustained long-term demand from e-commerce, life science and technology are fueling investment interest. Similarly, the data center sector is increasingly viewed as a stable, long-term investment opportunity.”

As far as outbound APAC investments are concerned, those reaching Canada far exceeded the investments made in the US for the first time, by securing a 42% share, followed by UK at 26% and Germany with 10%. The outbound volume to Canada was increased 18-fold, reaching $ 1.02 billion.

Li added “APAC investors to seek opportunities beyond US. The deviation from US could be a bid to diversify against rate headwinds in the world’s largest economy. While worries about the US regional banking industry have eased, banks generally report tighter lending conditions. Among APAC investors, Japan led the way in terms of investments in Canada, accounting for 43% of the total investment volume in the third quarter. The largest investor was KDDI, a telecommunications company, which acquired three data centers in Toronto, Canada, amounting to US$1.02 billion. This transaction also stands as the largest made by a Japanese investor in Canada. Singapore came in second, contributing 37% to the total volume for the quarter, primarily due to GIC’s involvement in several industrial transactions in Germany.”

Speaking about the shift in investment among APAC investors, Neil Brookes, global head of capital markets at Knight Frank, said: “Many private offices and government linked companies in Singapore retain significant equity ready to be deployed. The wider market dislocation caused by rapidly increased borrowing costs creates opportunities for all equity investors to deploy capital while many other institutional investors are sitting on the sidelines. The strength of the Singapore dollar is also driving large institutions such as GIC and other Government-Linked Companies to pursue opportunities in markets such as Japan, China, South Korea, and Australia. Notably, GIC has consistently increased its allocation to the real estate asset class, with investments in the US now accounting for approximately 22.4% of the total inbound investment volume from Singapore.”