HONG KONG, November 7, 2025 – As Hong Kong marks the 10th anniversary of FinTech Week, technology heavyweight Tencent used the platform to spotlight how cross-border payments, AI, and cloud infrastructure are reshaping the financial landscape across Asia.

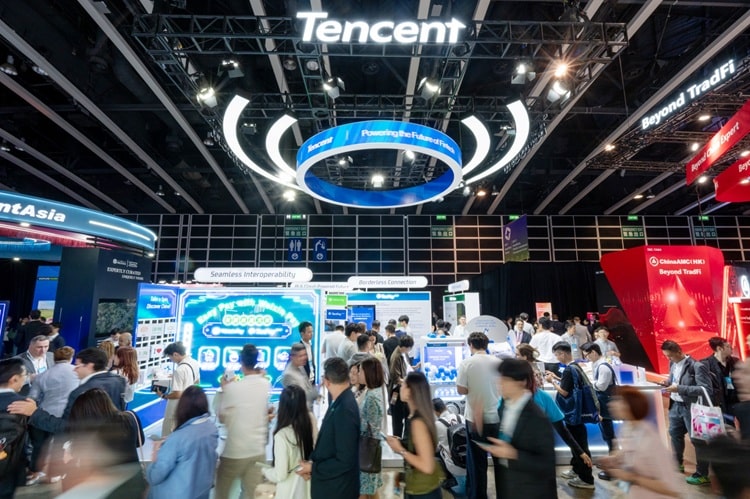

The company’s executives participated in several panels during the week-long event, detailing how Tencent is strengthening the interoperability of payment systems and pushing the boundaries of digital finance. The showcase drew strong interest from visiting delegations and top Hong Kong officials, including Chief Executive John Lee, Financial Secretary Christopher Hui, and HKMA Chief Executive Eddie Yue, who toured the company’s pavilion at the Hong Kong Convention and Exhibition Centre.

Payment Connectivity Takes Centre Stage

A key highlight of Tencent’s presentation was its role in China’s Cross-Border Interconnection Payment Gateway (CPG) — a unified framework designed to smooth friction in regional payment networks.

According to Forest Lin, Corporate Vice President of Tencent and Head of Tencent Financial Technology, fragmented standards and technology have long hindered cross-border payments. The new gateway, he said, aims to “enhance interoperability between regional payment systems” and reduce barriers for travellers and businesses operating across markets.

Through its TenPay Global platform, Tencent is now connecting Weixin Pay with more than 40 digital wallets in over 10 countries, including PayPal, Venmo, ShopeePay, WeChat Pay HK, Hipay, and LiquidPay. The move effectively opens access to tens of millions of merchants in China, enabling international visitors to make payments through their home wallets — a step that could significantly expand the reach of Chinese merchants and boost tourism-related transactions.

Industry analysts note that Tencent’s push reflects a wider trend among Asian fintech players to build interoperable payment ecosystems across borders — a theme echoed by regulators at this year’s FinTech Week, as regional economies look to streamline settlement systems and reduce transaction costs.

From Remittances to Retail

Tencent’s financial arm also showcased upgrades to its TenPay Global remittance network, which now spans more than 100 countries and has 60 global partners. Using Weixin’s ecosystem, the platform enables users to receive funds directly into their wallets “within seconds” — a feature the company says makes money transfer as simple as sending a chat message.

While the feature underscores the growing influence of China-linked fintech infrastructure, observers say the challenge will lie in maintaining compliance and data governance standards across multiple jurisdictions — particularly as regulators in Europe and Southeast Asia tighten scrutiny over digital money flows.

AI and Cloud in Financial Transformation

Beyond payments, Tencent Cloud highlighted how AI, digital identity, and cloud computing are transforming financial services operations. Demonstrations at the event included the Tencent Yuanbao eKYC system, the Agent Development Platform (ADP) for automation, and CodeBuddy, an AI assistant designed to enhance developer productivity.

Hu Liming, Vice President of Tencent Cloud, said that partnerships with Hong Kong-based institutions such as Fusion Bank, Airstar Bank, Futu Securities, and AIA have accelerated the city’s digital transformation. Fusion Bank’s 15-hour core banking migration and Airstar’s full shift to cloud operations were cited as examples of Hong Kong’s agility under strict compliance frameworks.

Tencent Cloud claims to now support over 10,000 financial clients across 20 countries, with nearly 400 overseas clients reporting double-digit growth.

Hong Kong’s Strategic Context

Tencent’s active presence at the 2025 edition of FinTech Week comes as Hong Kong seeks to reassert itself as a global fintech hub, with authorities relaxing virtual-asset rules and launching new channels for technology listings. The city is also positioning itself as a connector between Mainland China’s fintech ecosystems and global markets — a positioning Tencent appears well aligned with.

Analysts say the company’s efforts to unify payments and scale AI-driven financial infrastructure could strengthen Hong Kong’s ambition to serve as a testing ground for interoperable financial technologies that can later be scaled regionally.

Balancing Innovation and Oversight

Still, industry watchers caution that the rapid expansion of fintech interoperability — particularly across borders — will require strong coordination among regulators to ensure data security and consumer protection. With the rise of programmable payments and tokenised transactions, fintech players such as Tencent are navigating a complex environment that demands innovation without compromising regulatory trust.

As FinTech Week continues, Tencent’s showcase captures the dual reality of Asia’s digital finance transformation: massive technological opportunity on one hand, and the need for responsible innovation on the other.