India’s wealthy families are showing rising interest in aligning capital with purpose. Yet without structural integration, clearer measurement frameworks, and supportive policies, impact investing risks remaining a side experiment.

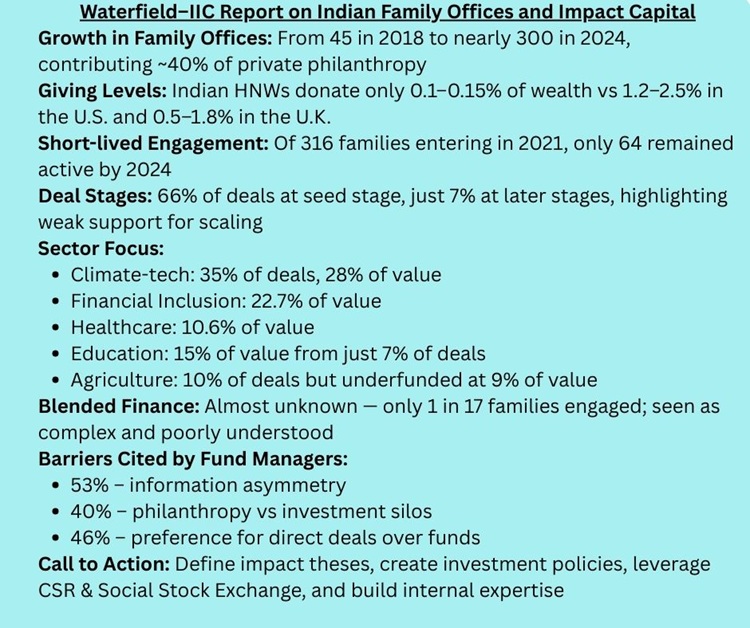

MUMBAI, September 17, 2025 — A new report by Waterfield Advisors and the India Impact Investors Council (IIC) underscores both the promise and the persistent gaps in how India’s high-net-worth (HNW) families engage with impact capital. The study, Unlocking Impact Capital – The Indian Family Office Edition (2025), finds that while participation in impact investing has grown, it remains fragmented, experimental, and heavily skewed toward early-stage deals, with limited long-term commitment.

From 45 to 300 Family Offices — But Modest Giving Levels

India’s family office landscape has expanded rapidly in recent years, rising from 45 in 2018 to nearly 30 0 in 2024. These families now contribute about 40% of private philanthropy in the country. Yet giving remains modest: Indian HNWs donate just 0.1% to 0.15% of their wealth, well below benchmarks in the U.S. (1.2–2.5%) and U.K. (0.5–1.8%).

The report stresses that India faces a social sector financing gap of INR 14 lakh crore (USD 170 billion) in FY2024, projected to widen further by FY2029. With public funding covering 95% of social expenditure, private capital from wealthy families could play a catalytic role in bridging this shortfall.

Weak Retention and Early-Stage Skew

Between 2021 and 2024, 923 HNW families made impact investments, but only 15% of deals were “pure” impact. Retention is alarmingly low: of 316 families who entered in 2021, just 64 remained active by 2024.

Deals are heavily weighted toward the seed stage (66%), with limited commitments at Series A/B and only 7% of deals at later stages. This reflects a cautious, exploratory approach rather than structured, sustained capital allocation.

Climate Tech Leads, Agriculture Trails

Climate-tech has emerged as the most active sector, accounting for 35% of deals and 28% of total investment value. Areas like sustainable mobility, clean energy, and climate resilience attracted growing attention.

Meanwhile, financial inclusion (22.7% of value) and healthcare (10.6%) remain core focus areas. Education, though fewer in number, drew larger cheques, accounting for 15% of investment value. By contrast, agriculture remains underfunded, with 10% of deals but only 9% of investment value.

Families Still See Philanthropy and Investment as Separate

Survey data highlights entrenched silos. Among 17 families interviewed, only three confirmed making impact investments, while 59% had not, and 24% were unsure whether their activity even qualified. Most continue to manage philanthropy through dedicated foundations and investments through separate teams, with little integration.

Rizwan Koita, co-founder of Koita Foundation, observed: “Impact investing often struggles to deliver meaningfully — neither on impact nor on financial returns. I prefer to support high-impact philanthropy on one side, and clear value-creating investments on the other.”

Blended Finance: Little Awareness, Limited Uptake

Despite global attention, blended finance remains poorly understood among Indian families. Only one out of 17 surveyed had engaged in such structures. Barriers include low awareness, lack of relatable case studies, and scepticism about whether benefits reach end beneficiaries.

Priyavrata Mafatlal, Vice-Chairman of Arvind Mafatlal Group, cautioned: “We need to be cautious about adding unnecessary complexity to what has traditionally been straightforward giving. If blended finance benefits intermediaries more than beneficiaries, its value is questionable.”

Fund Managers See Interest, But Small Cheques

Impact fund managers surveyed echoed similar concerns. While some families are exploring sector-aligned impact funds, participation is typically small-ticket and exploratory, often driven by personal relationships. Repeat allocations remain rare.

Recommendations: From Policy to Practice

The report outlines a toolkit to help families increase participation across the impact spectrum:

– Define an Impact Thesis linking personal values with measurable goals.

– Develop an Impact Investment Policy Statement (IIPS).

– Leverage blended finance and CSR funds to de-risk early ventures.

– Use the Social Stock Exchange (SSE) for transparent, outcome-linked giving.

– Build internal capacity or partner with experienced intermediaries to professionalise impact portfolios.

For Asia’s broader wealth ecosystem, India’s experience offers lessons. Family offices across the region are wrestling with similar dilemmas: balancing return expectations with social outcomes, building trust in blended models, and developing vehicles that make impact investing credible and scalable.

Burjis Godrej, MD of Astec Lifesciences, noted: “For the impact investing ecosystem to truly scale, fund managers need to engage more proactively with family offices, governments, and entrepreneurs — and clearly articulate both the impact thesis and the commercial terms.”

The Waterfield–IIC report calls for a reset: moving beyond episodic philanthropy and seed bets, toward a more strategic deployment of capital across the impact spectrum. If India succeeds, it could become a regional leader in mobilising private wealth for public good.