Intra-city delivery services climb 43.1% as food, retail and pharmaceutical deliveries fuel revenue growth; Last-mile services up nearly 57% on e-commerce demand; exclusive delivery for consumers triples.

HONG KONG, September 1, 2025 – Hangzhou SF Intra-city Industrial Co., Ltd. (9699.HK), China’s largest third-party on-demand delivery service provider, has posted record interim results for the first half of 2025, underscoring the resilience of its business model against a backdrop of global economic uncertainty and domestic headwinds.

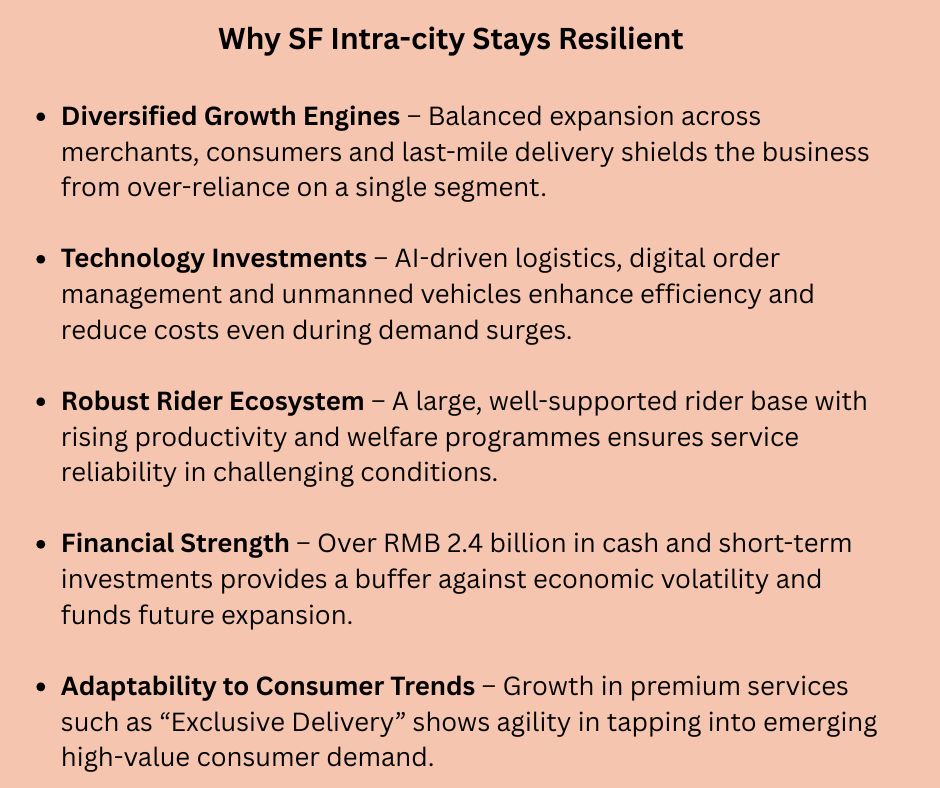

Revenue for the six months ended June 30, 2025 climbed 48.8% year-on-year to RMB 10.24 billion, while net profit attributable to shareholders rose 120.4% to RMB 137 million, the company’s highest on record. Adjusted net profit surged 139% to RMB 160.2 million, highlighting what management described as “high-quality and sustainable growth” despite market concerns about pressure on Chinese consumer demand and continued volatility in global trade.

Gross profit stood at RMB 680.8 million, up 43.8% from a year earlier, with margins remaining stable at 6.7%.

Balancing Growth with Market Pressures

China’s services and retail sectors have been grappling with uneven consumer sentiment, sluggish recovery in some regions or sectors, and rising competition. Against this backdrop, SF Intra-city’s merchant delivery services rose 55.4% year-on-year to RMB 4.47 billion, while last-mile delivery surged 56.9% to RMB 4.46 billion, driven by e-commerce partnerships and resilient demand in lower-tier markets.

“In the first half of 2025, we delivered strong financial growth despite an uncertain environment,” the management team said. “Leveraging our nationwide flexible capacity network and digital-intelligent capabilities, we not only captured new opportunities but also optimised efficiency and costs. This resilience has been vital at a time when many businesses in China are under pressure to maintain profitability.”

Consumer Confidence and Premium Demand

While consumer spending in China has shown signs of caution, SF Intra-city reported a 12.7% increase in consumer-facing deliveries, with premium services gaining traction. Its one-on-one “Exclusive Delivery” offering, catering to time-sensitive and high-value orders, saw revenue triple year-on-year, reflecting a willingness among segments of urban consumers to pay for reliability.

“Our ability to meet evolving consumer expectations has reinforced our position as the first choice for urgent and professional delivery,” the company noted, adding that expanding into non-food segments such as pharmaceuticals and retail helped diversify growth at a time when traditional categories face pressure.

Workforce, Technology and Resilience

The company’s rider base expanded to 1.14 million active riders, with productivity up 38% compared to last year. By strengthening welfare systems, offering financial and emotional support, and improving safety protocols, SF Intra-city said it has been able to keep rider morale high.

On the technology front, AI-driven logistics systems and the rollout of 300 unmanned delivery vehicles across more than 60 cities have helped the company manage demand spikes and maintain service quality.

“Investing in technology is not optional, it is essential to building resilience,” management commented. “In the face of macroeconomic challenges, automation and AI are helping us protect margins, improve efficiency and deliver a stable service experience.”

As of June 30, 2025, SF Intra-city held RMB 1.13 billion in cash and equivalents and RMB 1.26 billion in short-term investments, providing what the company described as “ample reserves to navigate market volatility and support future expansion.”

Sustainable Growth Amid Challenges

Looking ahead, the company said it will continue to prioritise sustainable growth, investing in technology, expanding its service scenarios, and deepening partnerships with merchants and traffic platforms.

“We are aware of the pressures facing China’s economy, from shifting consumer sentiment to rising costs,” management said. “But our commitment to being a neutral, open platform with full-scenario delivery solutions positions us well to weather these challenges. Our mission remains clear — to bring enjoyable lifestyle services to the fingertips of millions, while setting a benchmark for sustainable development in the industry.”