VICTORIA, SEYCHELLES, September 6, 2025 – Global cryptocurrency exchange MEXC has reported a record-high insurance fund of $559 million and the interception of nearly $5 million in fraudulent activity, according to its latest bi-monthly security report covering July–August 2025.

The exchange, which serves more than 40 million users across 170 countries, highlighted its continued focus on transparency, user protection, and market integrity.

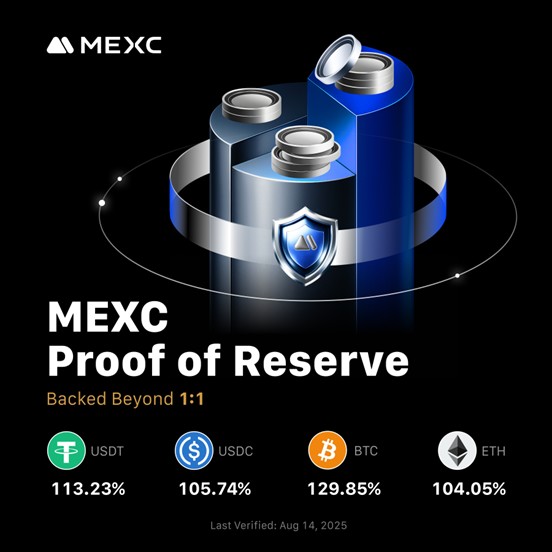

MEXC said its Proof of Reserves (PoR) data shows all major assets remain fully backed, with ratios comfortably above 100%. As of August 31, 2025, the exchange reported reserve ratios of 129.85% for Bitcoin (BTC), 104.05% for Ethereum (ETH), 113.23% for Tether (USDT), and 105.74% for USD Coin (USDC).

These figures, the company noted, underscore both the safeguarding of customer assets and liquidity buffers above industry standards at a time when exchanges are under heightened scrutiny for transparency.

Insurance Fund Hits All-Time High

The platform’s Insurance Fund, designed to protect futures traders from negative equity and extreme market volatility, reached $559 million USDT in July, the highest level to date.

According to MEXC, the fund’s growth enhances its capacity to ensure fair settlements for traders and reduce the need for auto-deleveraging in volatile market conditions.

Crackdown on Fraud and Market Abuse

The report highlighted extensive security measures undertaken in the July–August period. MEXC’s risk control team restricted more than 17,000 collusive accounts and 2,008 bot-trading accounts, signalling a tough stance against market manipulation.

In cooperation with law enforcement, the platform also processed 593 user assistance requests and 121 official freeze requests. A total of 48 fraud cases were intercepted, freezing $4.97 million USDT.

Additionally, MEXC reported it had successfully recovered $902,815 USDT in user funds mistakenly sent to wrong addresses, resolving 2,211 cases through manual intervention.

“MEXC is committed to setting a higher standard for security and transparency in the digital asset industry,” said Tracy Jin, COO of MEXC. “From maintaining reserves well above 100% to building the largest insurance fund in our history, every step we take is designed to protect users and reinforce trust. Our latest results demonstrate not only the resilience of our systems, but also our ability to prevent abuse and support our community with real, measurable impact.”

Founded in 2018, MEXC has built a reputation as one of the fastest-growing global exchanges, offering a wide selection of tokens, frequent airdrops, and low trading fees. Its latest security update comes amid ongoing industry pressure for exchanges to prove solvency and protect users against fraud, hacks, and market abuse.

The company’s latest report highlights both the scale of risks facing the digital asset industry and the increasing importance of proactive measures to safeguard users in an evolving regulatory and trading environment.